BENGALURU: Broadcast Audience Research Council of India (BARC) reported 1.73 percent growth in overall television impressions in week 30 of 2020 (Saturday, 25 July 2020 to Friday, 31 July 2020, week or period under review) to 17.6 billion weekly impressions from 17.3 billion weekly impressions in the previous week. This number is still 21.4 percent higher than the viewership of 14.5 billion impressions reported for week 4 of 2020.

BARC and Nielsen had set the average viewership data between weeks two and four of 2020 as the yardstick to measure television consumption trends during COVID-19 weeks. The author has considered week 4 of 2020 as the reference week here.

Viewership has been driven mainly by GECs after the series of UNLOCKs’ announced by the government and airing of new content created post UNLOCK. In week 30 of 2019, the growth drivers have been mainly South Indian channels and Hindi GECs. The analysis in this paper is limited to BARC data available in the public domain – the top 2,3,4,5 or 10 channels of the genre/sub-genre/language/platform/market. The unit of data released by BARC is impressions in thousands (000s). The channels in BARC’s weekly lists may vary week-on-week depending upon the viewership numbers in terms of weekly impressions each channel attracts.Conclusions by the author have been derived from this limited BARC data.

BARC data in the public domain for week 30 of 2020 reveals that the combined weekly impressions of the top 10 Hindi GECs on all platforms in the Hindi speaking urban and rural markets, HSM (U+R) increased 3.9 percent as compared to the previous week. Viewership of the top 5 channels of the four South Indian languages – Kannada, Malayalam, Tamil and Telugu also increased 7.1percent, 2.1 percent, 13.5 percent and 1.3 percent respectively. BARC considers the Hindi speaking market as all India minus the markets where the four South Indian languages are predominantly used – these are Karnataka (Kannada), Malayalam (Kerala), Tamil (Tamil Nadu and Puducherry and Telugu (Andhra Pradesh or AP and Telangana). By itself, the South Indian market is a huge market in terms of television penetration, and among the four, Tamil and Telugu markets are big in terms of population and TV homes. After the various Hindi genres, BARC provided the most segmented but limited data for the four South Indian languages in the public domain. BARC provides data for the Top 5 News channels in Hindi, the four South Indian languages and English in the public domain.

The other regional languages for which BARC releases limited data in the public domain are Assamese, Bangla, Bhojpuri, Gujarati, Marathi, Oriya and Panjabi. BARC provides data for the top channels in each of these languages – these could be GECs or News or Movies, as also separate data for the Top 5 News channels in Assamese, Bangla, Oriya and Marathi. week 30 of 2020 saw viewership of Top 5 channels of Assamese, Bangla, Gujarati and Marathi grow 9.4 percent, 4.1 percent, 2.2 percent and 6.2 percent respectively. Combined viewership of the Top 5 Bhojpuri, Oriya and Panjabi channels in week 30 of 2020 fell 4.9 percent, 0.03 percent and 4.9 percent respectively as compared to the previous week.

According to BARC data, GECs, movies, news and kids genres in that order garner around 90 percent of overall television viewership. GEC is the largest genre with about 45 percent of overall television viewership, with movies garnering between 23 to 27 percent of the viewership and the Kids genre about 7-8 percent. Post Covid2019, UNLOCK, the News genres has been garnering around 15 percent of television viewership.

Viewership of the Top 5 Hindi movie channels in HSM (U+R) on all platforms increased by 0.1 percent in week 30 of 2020 as compared to week 29. The Top 5 kids channels saw combined weekly impressions grow 2.6 percent during the week under review as compared to week 29 of 2020.

The Top 5 Hindi news channels in HSM (U+R) and the Top 5 English Nnews channels saw weekly impressions increase 3.7 percent and 12.4 percent respectively. The English news genre is a small sub-genre in terms of viewership.

Combined viewership of the Top 5 Assamese, Bangla, Marathi and Oriya news channels declined 9.9 percent, 4.3 percent, 6.6 percent and 0.03 percent respectively as compared to week 29. The Top 5 Kannada, Malayalam and Telugu news channels witnessed viewership dips of 18.4 percent, 2.5 percent and 3.9 percent respectively, while the Top 5 Tamil news channels saw weekly impressions increase of 7.2 percent in week 30 of 2020 as compared to week 29.

Hence overall viewership in terms of weekly impressions was driven mainly by Hindi GECs and channels in the four South Indian languages, with some help from the other three major television genres.

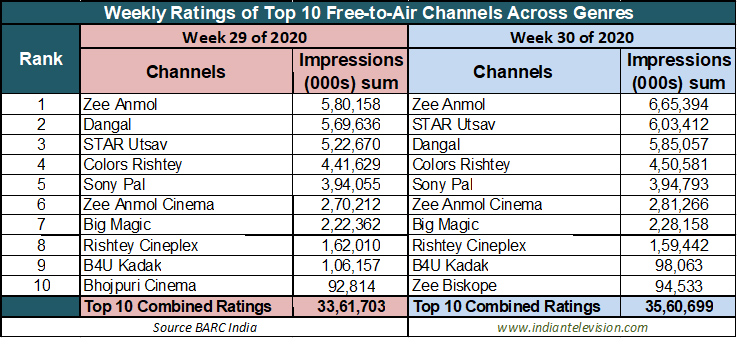

Top 10 Channels on All Platforms Across Genres

The Sun Tv Network’s flagship Tamil GEC Sun TV regained top spot as the most watched channel on all platforms across genres after a hiatus. All the 10 channels in BARC’s weekly list of Top 10 Channels on All Platforms Across Genres in week 30 of 2020 were the same as in the previous week, with some shuffling of ranks.

Seven Hindi GECs, two Telugu channels and one Tamil channel made up BARC’s weekly list of Top 10 Channels on All Platforms Across Genres in week 30 of 2020. There were 3 Star India channels, two channels each from Sony Pictures Network India (SPN) and Zee Entertainment Enterprises Limited (Zeel) and one channel each from Enterr 10 Television, Sun TV Network (Sun TV) and Viacom18 in the list for Top 10 Channels on All Platforms Across Genres in week 30 of 2020.

Please refer to the table below:

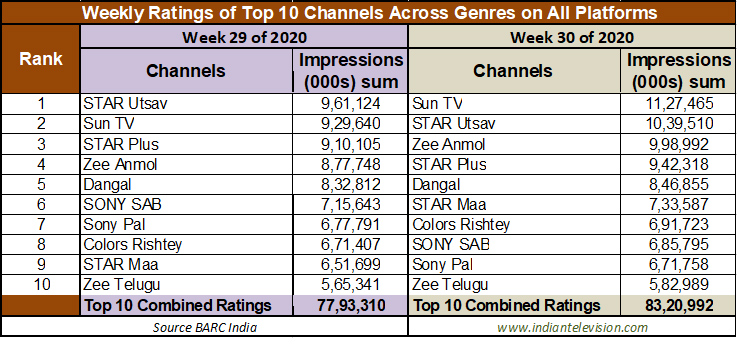

Top 10 Pay Channels Across Genres

Nine of the channels in BARC’s weekly list of Top 10 Pay Channels Across Genres in week 30 of 2020 were the same as in week 29. One Star India Hindi movies channel at rank 10 – Star Gold exited the list in week 30 to be replaced by another Star India channel – Tamil GEC Star Vijay at the same rank (rank 10).

There were three channels each from the Hindi GEC and Telugu genres, two channels from the Tamil genre and one channel each from the Kids and the Hindi movies genres in BARC weekly list of Top 10 Pay Channels Across Genres in week 30 of 2020. There were three channels each from Star India and Viacom18 (or associated with Viacom18 through its parent Network 18), two channels from SPN and one channel each from Sun TV and Zeel.

Please refer to the table below:

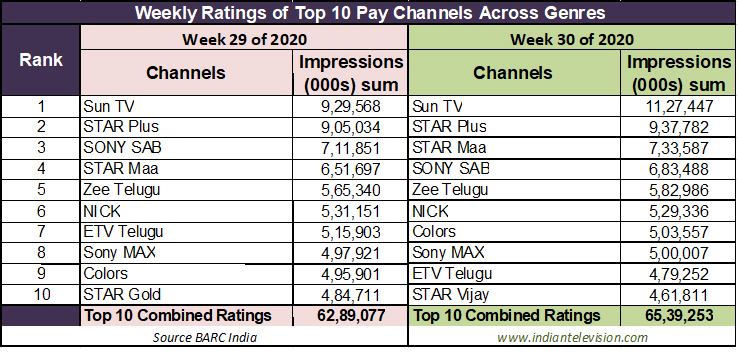

Top 10 FreeChannels Across Genres

Nine of the 10 channels in BARC’s weekly list of Top 10 Free Channels Across Genres in week 30 of 2020 were the same as in week 29. One channel – Enterr10 Television’s Bhojpuri channel, Bhojpuri Cinema, exited the list in week 30 of 2020 to be replaced by Zeel’s Bhojpuri channel Zee Biskope.

There were four channels from Zeel, two channels from Viacom18 and one channel each from B4U Network, Enterr 10 Television, SPN and Star India in BARC’s weekly list of Top 10 Free Channels Across Genres in week 30 of 2020. There six Hindi GECs, three Hindi Movies channels and one Bhojpuri channel in BARC’s weekly list of Top 10 Free Channels Across Genres in week 29 of 2020.

Please refer to the table below: