Mumbai: The latest edition of the IPL is just around the corner and Indian audiences are abuzz about what to expect from it with a new digital destination for the league in JioCinema. What spices up expectations this year even more is the advent of Connected TV which is bound to heighten the IPL viewing experience. JioCinema’s offering of free streaming of the IPL has made this year a bonanza both for cricket enthusiasts and advertisers. We will also see the viewership of the games reach record levels.

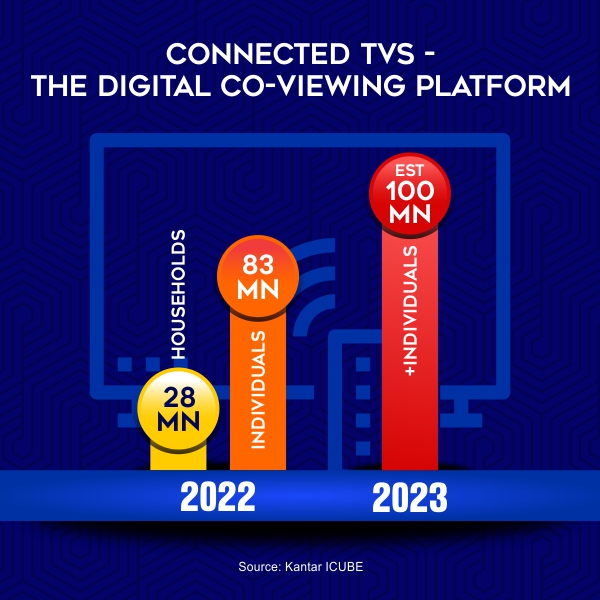

The latest Kantar ICUBE report states that the number of CTVs in India stands at a staggering 28 million in the last year alone. In terms of individuals watching content on CTV, the report pegs that number at a whopping 83 million. This could only go up multi-fold once the IPL is available for free streaming on CTVs, with an estimated 100 million+ viewers watching content on their CTVs later this year.

In recent years connected TV (CTV) has seen growth not only in urban but also Tier II and III markets. And that’s for a good reason. CTV offers viewers an enhanced, and technologically unparalleled viewing experience. Fans opting to catch the IPL on CTV get access to the blockbuster league with the whole family for free on JioCinema, and the 4k streaming offering makes the live sport viewing experience friction-free.

The penetration and demand of IPL on CTV would likely be accelerated further given the recently introduced ‘Jio Media Cable’ in households that don’t own a smart TV yet or do not wish to pay for cable or DTH. The device enables people to connect their phones to their regular TVs and convert them into smart TVs. This will add to the already existing CTV viewer base that will be watching IPL this year on Connected TV. In effect, this is expected to rake in more brands to consider digital as an advertising medium for the IPL for its larger base and potential for brand messaging.

Reports earlier stated that JioCinema is offering IPL in 12 regional languages this season, effectively meaning the average viewer will not just have the option to watch coverage in English or Hindi but in many other languages too. The benefits of this are also passed on to the advertiser that will have the flexibility not only to advertise in Hindi and English but also in regional languages.

IndianTelevision.com spoke to a few experts to understand what the wider reach and use of never-seen-before tech on CTV means from an ad standpoint. mediasmart Mobile vice president India & SEA Nikhil Kumar said, “With India’s largest sporting property around the corner, we are witnessing 2 schools of thought existing in parallel- one evangelizing continued growth within linear TV and the other rooting for the meteoric rise in CTV user base and continued mobile digital penetration for OTT platforms.”

He further goes on to add, “From a DSP vantage, mediasmart has always advocated for programmatic led, mid/down funnel attribution capabilities of CTV, leading to the development of proprietary products like CTV Household Sync within our portfolio. Tech capabilities like these have enabled us to build success stories across verticals & geographies. We are also moving towards a multi-screen audience approach, where the focus is on reaching the right audience, thereby making it platform/channel agnostic and minimizing ad fatigue/maximizing impact or ROAS.”

Efficacy Worldwide Pvt Ltd co-founder and chief operating officer Sapna Sharma stated, “With digital adoption overtaking the Linear TV reach, Connected TV and digital are becoming the most preferred media options for the audience to consume any content as the user experience and audience comfort is unparalleled to other mediums.”

She also added, “Sport Streaming platforms like Viacom are offering one of the best alternatives to the Linear TV sports channels as they provide a variety of sports options to watch and also provide the flexibility to watch any sport at one’s convenience. Viacom and the Jio app made a huge jump in terms of popularity and preference for the advertisers to drive an efficient ROI for their campaigns by providing one of the highest reach of audience and extremely efficient targeting capabilities to minimize the spillage and maximise the ROI.”

Finecast India (GroupM) national head – client development Rajiv Rajagopal says, “India is set to be the 3rd largest TV market by 2024. The rise in online streaming & consumers’ preference to watch content on the big screen has fuelled the growth of Connected TV. The accuracy at which CTV can serve an ad at the household level plays a crucial role in building an addressable TV ecosystem.

We have seen brands using CTV to run longer ad formats that are cost-effective and build high brand awareness & audience engagement. CTV advertising is evolving with tech interventions like ACR (Automated Content Recognition) giving more insights on the type of content being consumed at a household level and soon expecting creative innovations used in other advanced markets like shoppable ads, interactive ads to pick pace in India which will drive better ROI for brands. With cord switching and cord cutting, brands need to consider Total TV Planning and acknowledge CTV as an extension of Linear TV.”

Amplifi India chief investment officer Sujata Dwibedy mentions, “In today’s hyper-linked, data-heavy world, consumers want brands to offer more focused, relevant messaging. As a result, advertisers now realize that if they want to make a meaningful impact, they must shift from simply competing for eyeballs to designing meaningful, engaging experiences. Mobile-first Indian consumers are rapidly shifting towards connected TV (CTV) and over-the-top (OTT). While CTV viewing has increased by more than 80% globally, CTV adoption in India is still at a nascent stage but did grow hugely in 2021 and then in 2022. By 2025, it is estimated that there will be 100 Mn households in India, earlier this estimation was in the range of 45-50 Mn households.”

She goes on to add, “Many Indian consumers are replacing their traditional TV units with connected TV. One of the primary reasons for this change is the increasing preference towards OTT platforms, as India’s OTT market is one of the fastest growing globally. Another prime factor for the growth of CTV in India is the affordable, low-priced smart TV brands available in the market.”

“In addition to smart TVs, other devices for streaming content such as dongles are also widely available throughout the country now. The key catalyst for the next level of growth would be IPL on Jio. They are going to be streaming IPL live for free. The Jio Cinema’s enhanced tech experience and multi-language presence will give the user more control and drive them to view what they want to watch. “

She says,” Their streaming device which is priced very low (Rs 400 - Rs 500) can mirror the mobile on-screen converting any TV to a CTV! CTV will become a mass access entertainment platform & audience will widen for IPL. Growth should come from tier II and tier III markets. The only thing that could delay this process is the speed of the internet beyond the metros.”

Dwibedy asks how brands are getting value/ROI for the money spent. “Till now the CTV has not been very efficient as it came at a premium. The pricing was always 2x, or 3x of the normal buys. With IPL and an increase in mass reach, it will change the dynamics. We have started working with OEM partners like Samsung, etc. They will lead in the next few years, as the Smart TV price has been dropping and the ease of connectivity is paramount for entertainment. Advertisers have started testing these platforms very well.”

According to her, “The key metric on CTV that works well is Incremental reach; it could be used as an extension of linear TV campaign reach. It also enables more interactivity. CTV gives advertisers the ability to earn more stickiness, which increases brand awareness and opportunities for conversions. Hence Clients are willing to park certain budgets on CTV even if it is at a premium today. It is great for co-viewing & multi-screen audience to reach. There is a lot still to be done in this space, especially in terms of data measurement/ attribution and ROI, the journey has only begun.”

CTV is here to stay and one cannot deny the convenience it offers. It offers the flexibility of watching matches on any device anywhere and at any time. This IPL is going to be very exciting not only for the viewer but also for the advertisers.