Mumbai: Axis My India, a leading consumer data intelligence company, has unveiled the latest insights from the India Consumer Sentiment Index (CSI), shedding light on significant media consumption trends. With the ICC ODI Cricket World Cup 2023 in full throttle and India dominating, overall 67 per cent plan to watch the matches. A whopping 57 per cent are flocking to online mobile streaming platforms such as Hotstar for live action, while 49 per cent are hooked to their Linear Television sets, and eight per cent are watching it on Connected TVs. Oppo, Thums Up, Mahindra, Havells, and Dream 11 are the top recalled brands in the ICC ODI World Cup. The report also notes that 20 per cent of families are broadening their media horizons, with platforms such as TV, Internet, and Radio. Interestingly, consumption across these platforms remains consistent, showing no change from last month's figures.

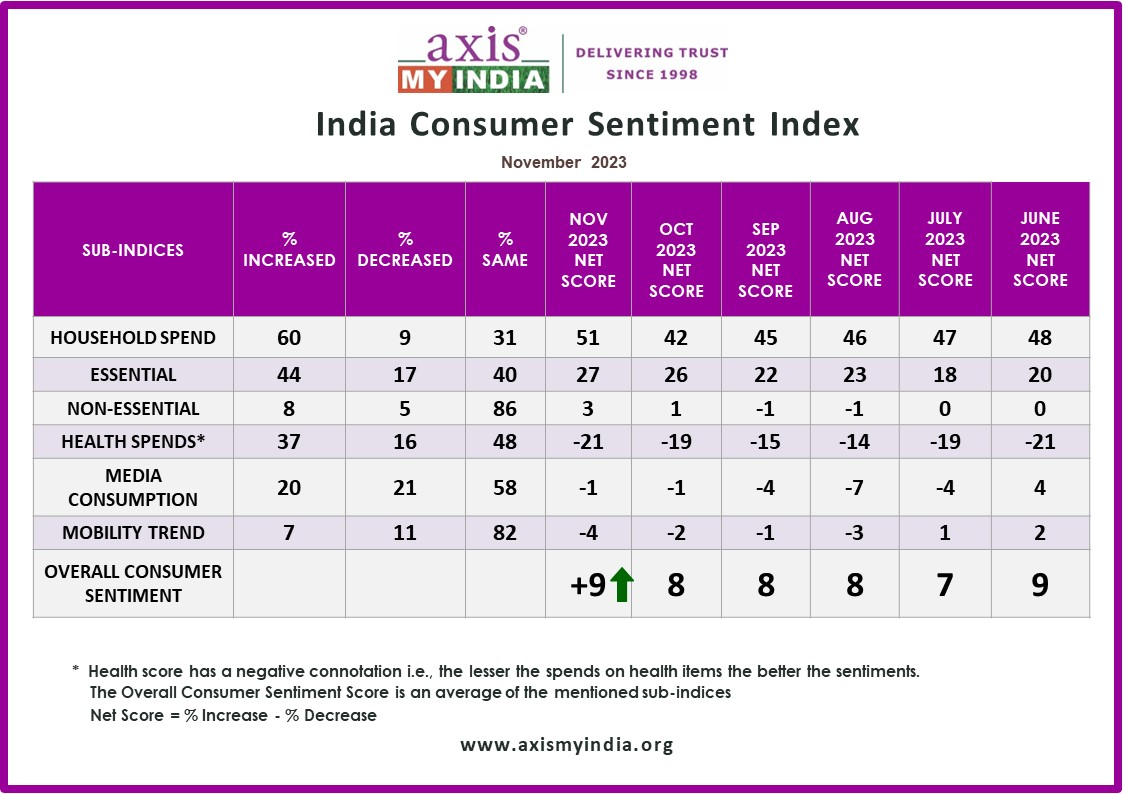

The November net CSI score, calculated by percentage increase minus percentage decrease in sentiment, is at +9, which is an increase of +1 from the last two months.

The sentiment analysis delves into five relevant sub-indices – Overall household spending, spending on essential and non-essential items, spending on healthcare, media consumption habits, and entertainment & tourism trends.

The survey used Computer-Aided Telephonic Interviews and included 4,980 participants from 35 states and UTs. Among them, 69 per cent were from rural areas and 31 per cent from urban areas. In terms of regions, 23 per cent were from the North, 25 per cent from the East, 28 per cent from the West and 23 per cent from the South of India. Among the participants, 65 per cent were male and 35 per cent were female. Looking at the largest groups, 34 per cent were aged between 36 and 50 years old, while 27 per cent were aged between 26 and 35 years old

Axis My India Chairman & MD Pradeep Gupta said, " As the pulse of the ICC ODI Cricket World Cup 2023 quickens, India's enthusiasm resonates across both fields and screens. While a significant portion of fans eagerly tune in for the critical matches, we are seeing a blend of modern and traditional viewing preferences. Digital platforms are commanding attention, yet the charm of conventional cable/DTH remains unshaken. Interestingly, amidst the cricketing showdown, advertisements continue to play their own game of capturing viewer attention. This amalgamation of viewership patterns and advertising impact offers a compelling insight into a nation deeply invested in the sport, both on and off the pitch.”

Key findings

● Consumption of media (TV, Internet, Radio, etc.) has increased for 20 per cent of families which is the same as last month. The net score, which was -1 last month, also remains the same.

● Overall household spending has increased for 60 per cent of the families, which is an increase of seven per cent from last month. Consumption remains the same for 31 per cent of families. The net score, which was +42 last month, has increased to +51 this month.

● Spends on essentials like personal care & household items have increased for 44 per cent of families, which marks an increase of one per cent from last month. Consumption remains the same for 40 per cent of families. The net score, which was at +26 last month, has surged to +27 this month.

● Spends on non-essential & discretionary products like AC, Car, and Refrigerators have increased for eight per cent of families. Consumption remains the same for 86 per cent of families. The net score, which was +1 last month, is at +3 this month.

● Expenses towards health-related items such as vitamins, tests, and healthy food have surged for 37 per cent of families, which marks an increase of one per cent from last month. Consumption remains the same for 48 per cent of families. The health score which has a negative connotation i.e., the lesser the spends on health items the better the sentiments, has a net score value of -21 this month.

● Mobility has increased for seven per cent of the families, which is a decrease of one per cent from last month. The net score, which was -2 last month, is at -4 this month. Mobility remains the same for 82 per cent of the families.

On topics of current national interest

● In the ICC ODI Cricket World Cup 2023, with the Indian team leading the table over 67 per cent plan to watch the matches. Out of them, 26 per cent of the respondents intend to tune in for the crucial final games of the current season. Meanwhile, 22 per cent of respondents are following matches played by their preferred team, and 19 per cent of respondents are watching almost every game of the season.

● During the ICC ODI Cricket World Cup 2023, various viewing platforms have gained traction among audiences. The survey reveals that a dominant 57 per cent of respondents are catching the action live online mobile streaming platforms such as Hotstar. Traditional cable/DTH television still holds its ground with 49 per cent of respondents tuning in through this medium. Notably, emerging technology isn't left behind, with 8 per cent of enthusiasts streaming the matches on connected television sets using devices such as Fire Stick TV, Chromecast, and similar platforms.

● During the ICC ODI Cricket World Cup 2023, advertisements played a pivotal role in capturing viewer attention amidst the on-field action. According to the survey, mobile phone brand Oppo made a significant impression, with 16 per cent of respondents recalling their advertisement the most. Close on its heels, 13% each have recognised advertisements from brands like MRF, Thums Up, Pepsi, Coca-Cola, and Havells. Additionally, Dream11, a fantasy sports platform, also managed to engage the audience effectively, with 12 per cent of respondents recalling their promotional content.

● The survey delved into consumers' intentions regarding their shopping preferences during the upcoming festive season. Notably, 25 per cent of the respondents are enthusiastic about shopping more as compared to last year while 23 per cent are committed to sustaining their purchase levels as last year.

● The survey provided insights into household shopping budgets for the forthcoming festivities. A notable 56 per cent of respondents are set to shop on a budget of less than Rs 5000, while 24 per cent plan to shop in the range of Rs. 5,000 - Rs. 10,000. Furthermore, 11 per cent of the respondents are looking to spend between Rs. 10,000 - Rs. 20,000, while a combined segment of seven per cent is gearing up for shopping sprees ranging from Rs. 20,000 to a lavish Rs. 2,00,000. A significant one per cent of the overall population plans to spend more than Rs. 2,00,000.

● During the auspicious festive occasions, the spectrum of consumer purchases is broad and varied. It encompasses customary clothing and apparel but also extends to high-value items. These items range from the latest electronic gadgets, such as mobile phones, to indispensable home appliances, and even luxury investments like vehicles, real estate, and jewellery. A significant majority of 67 per cent of respondents, indicated their intent to shop for clothes/apparel. Furthermore, 13 per cent of the respondents have their eyes on a new mobile phone, while a noteworthy 12 per cent of the respondents are aiming to enhance their homes with appliances such as ACs, TVs, washing machines, refrigerators, and more. Five per cent plan to buy a four-wheeler.

● The survey explored the preferences of participants concerning various shopping channels they prefer when purchasing festive items. A significant 82 per cent of respondents voiced a preference for local physical retail stores near home indicating a potent sentiment towards bolstering local enterprises. On another note, 10 per cent of the respondents leaned towards online shopping platforms for their festive acquisitions. Meanwhile, eight per cent of respondents expressed favour for brand-specific physical stores, highlighting a range of diverse shopping inclinations among consumers.

● Festive shopping popularised by e-commerce platforms has emerged as a significant favourite, especially with the advent of special promotions. These themes have become increasingly popular among consumers. According to the survey, a noteworthy 22% of respondents have expressed their intention to actively participate and make purchases during these e-commerce-led shopping festivals.

● In the vibrant landscape of festive shopping, payment preferences reflected a blend of tradition and modernity. Amid the festive hustle and bustle, a substantial 79 per cent of respondents gravitate towards the timeless charm of cash for their transactions. In a modern twist, 16 per cent of respondents are inclined to embrace digital wallets to settle their festive purchases, while 5 per cent opt for the convenience of debit/credit cards and online banking for transactions.

● Diwali, often hailed as the festival of prosperity and wealth, brings with it the added delight of financial bonuses for many. Employers often mark the occasion by distributing salary bonuses, allowing employees to indulge in the festive spirit with a little extra in their wallets. According to the survey, a notable 19 per cent of respondents have received /are anticipating receiving a salary bonus due to Diwali celebrations.