The global sports industry is estimated be worth of $600 - $700 billion. Revenue generated from the industry is estimated at $80 billion globally and is growing at Compound Annual Growth Rate (CAGR) of 6.5 per cent over 2009 to 2014, which includes revenues from media rights, sponsorships and ticketing.

The market for advertising in sports in India was estimated at Rs 41 billion in 2013 growing at a CAGR of 14 per cent from Rs 21 billion in 2008. It consists of on ground advertising, team sponsorship, athlete sponsorship and media ad spends on sports. Licensing and merchandising contribute Rs 2 billion to the industry in India. Gate revenues make up another revenue stream but its contribution to the sports market in India is relatively low compared to media ad spends and sponsorship.

Sporting events have been popular throughout history, and have gained greater viewership with bigger stadiums and TV broadcasting of domestic and global events. Annual sports viewership in India reached 276 million in 2014. But the sports genre accounts for only 2.4 per cent of total TV viewership and 4.3 per cent of AdEx (Advertisement Expenditure) revenue in the Indian TV industry, much smaller than the general entertainment genre.

The median age in India is around 27 years and around 64 per cent of the population is expected to be in the working age group by 2020. This provides a large and growing target segment for sports in India. Moreover, an increase in percentage of middle class and rich households (households with annual income greater than Rs 2,00,000) from 6.1 per cent in 2001-02 to 14.5 per cent in 2009 -10 has increased the number of people with an appetite for sports consumption. The middle class alone is expected to increase to 41 per cent of the population by 2025. There has also been an increase in the average share of educational and recreational activities in the annual household consumption and it is estimated to increase from five per cent in 2005 to nine per cent by 2025.

A good start to non cricket sports is one interesting to look at the growth of sports other than cricket in India. Many sports have grown well over the last half decade. A survey on the popularity of sports in the Indian online community reports that while 85 per cent of respondents followed cricket in some manner, an estimated 44 per cent followed tennis, 41 per cent followed football (soccer) and 32 per cent followed badminton. With economic development, sports viewership in a country usually moves from single sport to multi sport. Africa and the Indian subcontinent have been traditionally dominated by football and cricket respectively. However, with greater economic development, India is seeing a growth in other sports as well.

League formats have helped in increasing popularity of sports Globally

The leagues system has served as an important way for companies to enter the sports sector. A sports league creates several opportunities for private companies in domains such as league management, franchisee, broadcasting and sports videos production houses, advertising, sports infrastructure such as multipurpose venues, player management, licensing and merchandising. One of India’s most successful leagues in terms of viewership and revenues has been the Indian Premier League (IPL), which is based on the English Premier League (EPL) format. The league was launched in 2008 by the Board of Control for Cricket in India (BCCI) with eight city franchisees. Though it is still small in comparison to some of the biggest leagues of the world, it has been able to achieve success in a short span of time, which other mature leagues could not manage to do. The evolution of IPL as a brand is an example of successful product innovation, which effectively combined entertainment and sports. The Twenty20 (T20) format of IPL has made the sport more popular and convenient to watch for cricket enthusiasts. The success of the IPL, which is estimated to have had a viewership of 191 million people and ad revenue of Rs 8 billion in 2014 has led to the creation of several other league-format sporting events, such as the Indian Badminton League, Hockey India League and the recently launched Pro-Kabaddi League. The inaugural season of football’s Indian Super League has been fairly successful as well. Cumulative reach of Pro Kabaddi League was 435 million compared to 560 million for IPL in 2014. Football’s Indian Super League was close with 410 million cumulative reach. The new domestic sports leagues however require significant management efforts over a period of time to get established and be successful.

Viewership refers to sum of weekly GVTs, which is a factor of number of viewers and frequency.

IPL leads the cumulative reach chart amongst sporting events held in 2014

Cumulative reach refers to the number of individuals within the target group who viewed the tournament over a certain period of time, including duplication.

Ecosystem to support sports development in India

However, in order to sustain the growth in sports and sports-related businesses, a flexible regulatory and policy framework that is able to realise synergies between various segments of sports needs to be developed. This in turn requires the sports ecosystem and its stakeholders to be recognised under the purview of a dedicated industry of sports which can provide impetus to an organised and professional business environment for sports in India.

Sports Broadcasting in India

There has been a surge in the number of sporting events broadcast in the past few years. These events include tournaments and leagues played at state, national and international levels. Several international tournaments and leagues played at the regional or global level are now telecast in India bringing in a larger and much diverse audience. Males form around 60 to 65 per cent of viewers and are expected to continue to be the main target segment. However, the number of female viewers has been increasing. About 57 per cent of the viewership of ISL and 53 per cent of the viewership of Pro – Kabaddi League was made up of women and children. Broadcasters are supplementing the sports with other entertaining and informative pieces to make the program more inclusive.

Getting to the right content mix

With the rise in number of sporting events, sports channels are covering several sporting events in their annual calendar. It consists of a mix of marquee events from domestic and international leagues, major tournaments along with minor domestic leagues and tournaments.

Star Sports has revamped itself with uniformly branded eight channels to showcase a variety of domestic and international sports both cricket and non – cricket and in English as well as Hindi. While international cricket matches featuring India will make up 65 per cent of Star Sports 1, Ranji matches, university and women’s cricket and international cricket matches not featuring India will form 50 to 60 per cent of content on Star Sports 2. This will enable Star to nearly double its cricket content, which is the major revenue driver for sports channels in India. Star Sports 4 will feature other sports, which include international football (soccer), European soccer leagues, badminton, tennis and Formula-1 racing.

The new Indian leagues, which include hockey, badminton and soccer, will be telecast on Star Sports 1 to 3 to reach a larger audience. Such a strategy enables Star Sports to increase its cricket content as well as broadcast non – cricket sports, which are seeing increasing traction. There is also an increasing trend towards multi-sports channels, as the viewership of different sports are increasing and sports channels are vying for TV rights across sports. Star has seen a shift from having a cricket specific channel in its cluster to multi-sports channels. It enables Star to broadcast both international and domestic cricket content simultaneously as well as gives it flexibility to show different sports across different channels. This can be attributed to the large investments made by Star to purchase rights for domestic and international cricket, football, tennis, badminton etc.

On the other hand, Neo has rebranded its cricket specific Neo Cricket to Neo Prime on account of reduced live cricket properties and surge in volume of several sports.

Ten however, has sports specific channels with Ten Cricket for cricket, Ten Action for football and Ten Golf for Golf broadcasting. Availability of sufficient single sport media rights and a definite viewership base for that particular sport drives the presence of sports specific channels. This helps advertisers to target a specific audience, for example luxury products have tied up with Ten Golf. Although, digitization and lower costs of distribution make single – sport channels more viable than before, it can take some time to evolve in India and reach the popularity of golf and tennis channels in some developed countries.

Regional language boost to broadcasting

Another strategy to target a specific audience is the language of telecast. Hindi and other regional languages increase the audience reach for sports as English has a limited audience. Star Sports 3 replicates Star Sports 1 in Hindi. In 2014, it telecast the domestic football league - Indian Super League in five languages. Its regional TV channels were used to telecast the league in Bengali, Kannada and Malayalam apart from English and Hindi broadcasts. During FIFA World Cup 2014, Bengal accounted for half the country’s viewership mainly because of regional language feed by Multi Screen Media (MSM) on its Bengali general entertainment and film channel Sony Aath. Hindi broadcast of the Pro Kabaddi League on Star Gold also helped take the cumulative reach to 435 million for the event. Other than using regional sister channels for feed in local languages, sports channels may spin off separate regional language sports channels if the demand picks up.

Revenue and Profitability model

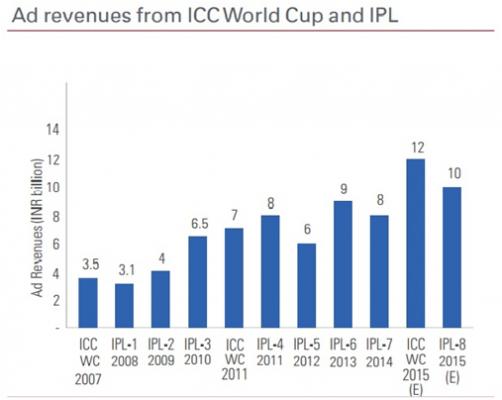

Sports industry is still an ad driven revenue model. Media spends on sports, most of which is on TV, increased from Rs 11.5 billion to Rs 22.5 billion over 2008 to 2013 at a CAGR of 14 per cent. In mature markets, subscription is the main revenue driver for sports channels, contributing nearly 60 to 90 per cent of the revenues. However in India, advertisements still account for nearly 60 per cent of the revenues of sports channels, mainly driven by cricket, which is the largest revenue spinner and accounts for nearly 80 to 85 per cent of the total television sports media revenue. Non-cricket sports provide live sports content around the year, which gives advertisers a regular touch-point to their target segments. Revenues from advertisements in any year vary depending on the tournaments and series held during the year. Cricket mostly forms the peaks whereas the troughs are being evened out with non–cricket sports and non-live cricket content. In 2011, ad spends on TV for cricket was estimated to have crossed Rs 20 billion. In 2015, ad spends from the ICC World Cup and IPL 8 alone are expected to be around Rs 22 - 25 billion. Ad revenues for non-cricket sports are only a small fraction of cricket revenues. In 2013, ad revenues from Indian Badminton League and Hockey India League were Rs 0.9 billion and Rs 0.7 billion respectively.

Key challenges facing the spurt of non-cricket leagues in India includes:

- Poor investor confidence

For instance the Indian Badminton League (IBL) suffered a loss of Rs 25 crore in the opening season in 2013 owing to investors pulling out casting doubt on the return of IBL with its second season. However, despite no play in 2014, the IBL is set to return in 2015.

- Lack of industry status

Provision of industry status could lead to an organized sports industry leading to higher available capital, newer sports businesses, additional revenue streams for stakeholders making leagues commercially viable ventures.

- Lack of a culture for sports

Sporting leagues in India are designed to last just a couple months every year. However, many major sporting league seasons in the world last for longer durations every year. Sporting leagues need to become year round (or at least three – four months a year) ventures. Apart from the benefit of a longer engagement with viewers (allowing the building of a larger fan base and culture for the game), this also touts the idea of sport becoming a year round profession furthering the advent of sports businesses.

Revenue model in leagues

Major sources of revenue for any league come from media rights, sponsorships and revenue from franchisees. Share of franchisee consideration in IPL has increased from 30 per cent in 2010 -11 to 37 per cent in 2012- 13 with a corresponding decrease in the revenues from sponsorship rights. Income from media rights and other sources have nearly the same share in 2012-13 as in 2010- 11.

Major Sources of revenue for a League Franchisee

Major sources of revenue for any league franchisee are share of the central revenues, local revenue and performance revenue.

- Share of central revenue

This includes a percentage of the revenue to the league from media rights and central sponsors like Pepsi in the IPL. In India, media rights are a major revenue sources both for the league and the franchisees. Channels are expected to further increase the subscription revenue for sports channels.

- Local revenue

Local revenue for a franchise entails revenue from match day ticket sales (gate revenue) and commercial revenue that includes funds from franchise sponsors, merchandise sales and revenue generated from membership with the franchise club if any. However, revenue from franchise sponsors makes for a majority of the commercial revenue. Sports merchandise sales is a fast growing segment with Rs 2 billion in retail sales in 2013. Moreover, contribution of gate revenue to overall revenue of franchises is low due to inexpensive ticket pricing, especially in non-cricket leagues. This is in contrast to leagues abroad where gate revenues are a significant contributor to a franchisee’s revenue.

How can leagues be further popularised/ monetized?

Some of the critical success factors of a league in India are identified below:

- Players

Involvement of top players of the world creates interest in the viewers and increases the quality of the game. The IPL is a successful example of the same. On the other hand, I-League is struggling to attract top players resulting in poor viewership.

- Marketing

An effective marketing campaign is another critical factor in making the league popular. Again, the involvement of various celebrities as brand ambassadors or owners in the IPL contributed to generating larger viewer interest in the league. In fact, the marriage of the Indian entertainment industry and cricket has aided in making IPL a commercial success.

- Governance framework

It is seen that leagues, which are run with the support of the approved federation have been able to sustain. The ICL failed due to lack of support from BCCI and World Series Hockey (WSH) is facing similar troubles due to non-recognition of the founding federation as the official national sports federation of hockey itself.

- Stadium Infrastructure

Quality of stadium infrastructure improves the viewing experience, hence increases the level of interest in the sport. It is important to create supporting infrastructure like restaurants, bars, fast-food chains, merchandise, stores, books and music stores, etc. to develop stadiums into popular entertainment spots for the family. Hike in ticket prices subsequent to rise in viewership, organizing multiple sporting events and entertainment shows wherever possible can help monetise stadium infrastructure.

- Fan base

An effective strategy to increase a franchisee fan base is engagement of respective franchises with local community. This helps generate greater TV viewership, increase attendance of matches and sale of merchandise. Performance of national team or players at international level increases the interest in the game, hence the league.

League timing

The tournament should be held at a time when there is no clash with international tournaments that could divert a significant section of the viewers, many players are available and weather is suitable for holding matches. The length of games and timing of matches (conducive for family viewing) are also important factors to consider, both having further helped significant viewership of the IPL. Other factors may include spectator friendly broadcasting such as better viewing angles and broadcasting in Hindi and English.