MUMBAI: Covid2019 has plummeted what was a skyrocketing cost of customer acquisition, according to a report that delves deep into the correlation between the pandemic and the entertainment industry. According to the special report, Navigating Covid-19, by Parrot Analytics, this is exciting for platforms launching in the middle of pandemic such as Quibi, HBOMax, and Peacock. Yet, as time stretches on, OTTs may lose subscribers whose free trials end or who churn due to the recession. After the lockdown, the demand for content may be even more important as out-of-home activities will pose greater competition.

Under stay-at-home orders, OTTs are gaining subscribers due to consumers’ heightened perceived value of their catalogue offerings.

The report says that the global lockdowns, forcing everyone to be home, have led to increased content consumption (viewership, ratings, etc.). Yet, this increased consumption has been accompanied by the unique challenges of satisfying audiences while production of key tentpoles has been halted and delayed. Broadcasters and cable (Pay-TV) have additional hurdles compared to OTTs. They must also cope with reduced ad revenue within the industry, making their ability to optimize their airing schedules and to fill content gaps even more crucial. Nonetheless, OTTs and Broadcasters alike are looking to solve their challenges by acquiring and producing virus-proof content.

Meanwhile, distributors have an opportunity to revisit and leverage their reserve of content. They can offer unique packages of titles that will allow platforms and channels to retain their viewers and subscribers. Producers are challenged with finding innovative ideas and formats as well as adapting existing ideas to new restrictions placed during and post-lockdown. Simultaneously marketers are left searching for fragmented and dispersed audiences, recalculating and holding on allocating budget.

Pay TV

In the short-term, Pay TV has similarly seen a surge in viewership and ratings. Yet, as industry analyst Rich Green- field points out, this bump has been underwhelming. Greenfield is not alone; many analysts expect networks to feel more repercussions due to their losses of advertising, their reliance on live TV, and their battle for a digitally orient- ed key audience: those between 18-24. When consumers are faced with hard choices, Covid2019’s impact long-term may accelerate cord-cutting, contributing to Pay TV’s decline. However, broadcasters can avoid this by capitalizing on audiences who are tuning in now.

What qualities have created opportunity under stay-at-home measures?

According to the report, there are a few characteristics of SVODs that have been advantageous during the lockdowns.

• Size of catalogue: The lockdown conditions have temporarily increased the value of all content, making it easier to reach the threshold of demand needed to acquire a customer. Thus, the larger the catalogue the greater the likelihood of customer acquisition at the moment.

• Supply of originals: As stay-at-home orders continue, boredom and loneliness is on the horizon for many consumers. This makes original content that connects people more important than ever.

• Flexible viewing: With families, roommates, and others forced to share living spaces, SVOD content avail- ability on multiple screens is an advantage. The flexibility to watch on TVs, laptops, and phones allows consumers to watch their preferred content wherever they want and with whomever they want.

• Ad-free: Declining revenue from advertising poses a unique challenge at the moment; many companies have cut their marketing teams, frozen budgets, and are limited in ad-production capabilities. Thus, SVOD’s diminished reliance on ad-revenue is beneficial.

Netflix

Consider Netflix. Its large catalogue, supply of diverse original content, flexible availability and lack of ad-reliance allows it to thrive at this moment. The crisis has also temporarily reverted Netflix to an earlier phase in OTT life-cycles, in which total demand for content dictates subscriber growth and retention.

Netflix is not alone, Disney+ also exhibits similar qualities. Although it has a limited supply of originals, its flexible access, ad-free platform, and large catalogue of premium children’s and family-friendly IP support its ability to thrive. Amazon Prime Video and Hulu are also well positioned with large catalogues, many originals, and flexible viewership.

For Pay-TV, channels with large catalogues of family-friendly content, such as Discovery and Disney, are fulfilling increased demand from kids who are home due to school closures. Other broadcasters which are experiencing holes in programming are employing repeats or flashbacks of favourite episodes, searching for foreign acquisitions, and considering moving exclusive content from their OTT platforms back

The key for producers and distributors is therefore to capitalize on this need for a larger catalogue and greater supply of originals. They can solve the pains of an aching industry with innovative content that fulfils and attracts the audiences that platforms, networks, and marketers are seeking to find.

What can the industry do to thrive moving forward?

In the midst of uncertainty, data allows decision-makers to be agile, says the report.

Covid-2019’s effects on the global TV industry have likely just begun to unfold. As new consequences emerge, the industry will need to adapt swiftly by combining the art of storytelling with the science of human behaviour.

Content preferences

Audience content preferences have shifted due to Covid2019, these include a desire for original content, especially content that fills holes left by cancellations or delays.

OTTs have an opportunity for growth due to increased streaming volume, but in order to prevent churn they must optimize their release schedules and content acquisitions.

Broadcasters are challenged with holes in programming schedules, but can adapt by reinvigorating fandoms and finding replacement titles that will attract target audiences.

Distributors should optimize their content packages for broadcasters and OTTs in need.

Producers, despite shutdowns, can be resilient by prioritizing projects that fulfil audiences’ shifting demand and finding new formats to create fresh content.

Marketers may need to pivot their channel spends, but can find ways to maximize their audience reach and tap into emerging preferences.

OTT solutions

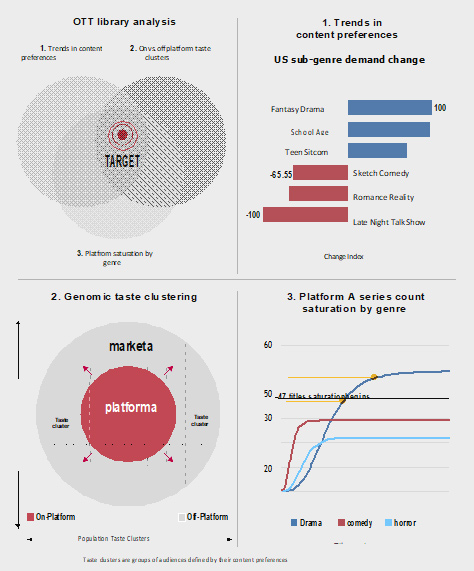

Capture shifting preferences: By examining trends in content preferences, OTTs can prioritize speeding up releases or acquiring titles that may appeal to audiences’ shifting needs.

Acquire vs. retain subscribers: Platforms must evaluate whether titles fulfil the preferences of existing subscribers or those yet to be acquired. Depending on an OTT’s goals, they may choose to prioritize a title that targets retention or to prioritize a title that targets acquisition.

Ensure audiences are satisfied, but not overloaded: Saturation is another term for diminishing marginal returns. Based on past data, OTTs can derive an optimal point or a point of saturation. To ensure audiences are not over- whelmed, OTTs should evaluate if there is headroom before speeding up releases or acquiring titles. Otherwise, due to genre saturation, titles may underperform.