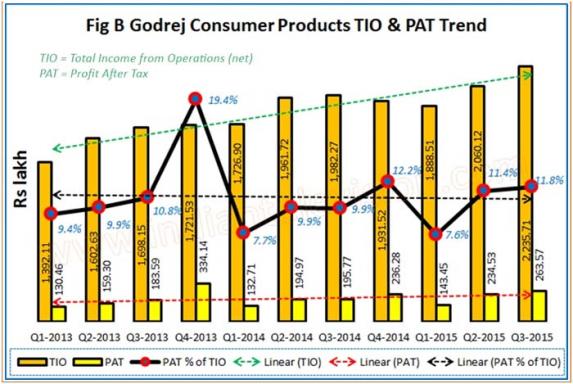

BENGALURU: Following a strong turnaround in the last quarter, Godrej Consumer Products Limited (GCPL) reported 12.8 per cent y-o-y growth in consolidated Income from Operations (TIO) to Rs 2235.71 crore from Rs 1982.27 crore and an 8.5 per cent q-o-q growth from Rs 2060.12 crore. For the nine month period ended 31 December, 2014 (9M-2015), the company’s TIO increased 9.1 per cent to Rs 6184.34 crore from Rs 5670.89 crore in 9M-2014.

Note: 100,00,000 = 100 lakh = 10 million = 1 crore

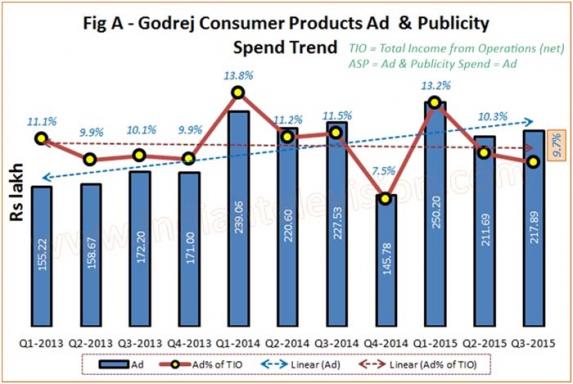

GCPL‘s advertising and publicity spends (ad) in the current quarter reduced 4.2 per cent to Rs 217.87 crore (9.7 per cent of TIO) from Rs 227.53 crore (11.5 per cent of TIO) in the corresponding year ago quarter, but increased 3 per cent from the Rs 211.69 crore (10.3 per cent of TIO) in the preceding quarter. In 9M-2015, the company’s ad spend was 1.1 per cent lower at Rs 6709.78 crore (11 per cent of TIO) than the Rs 687.19 crore (12.1 per cent of TIO) in 9M-2014.

During the 11 quarter period starting Q1-2013 until Q3-2015, GCPL’s simple average ad spends was 10.8 per cent of TIO. Consequently, the current quarter’s ad spends were 1.1 per cent lower than average. GCPL’s ad spend shows an increasing linear trend in terms of absolute rupees, but a liner dip in terms of percentage of TIO during the period under consideration. GCPL’s highest ad spends in terms of absolute rupees and percentage of TIO was in Q1-2014 at Rs 239.06 and 13.8 per cent of TIO respectively. The company’s lowest ad spend in terms of absolute rupees and percentage of TIO was in Q4-2014 at Rs 145.78 crore and 7.5 per cent of TIO.

GCPL’s TIO in the current quarter was the highest. TIO shows an increasing linear trend during the period under consideration.

The company’s profit after tax (PAT) in the current quarter increased 20.3 per cent to Rs 263.7 crore (11.8 per cent of TIO) from RS 195.77 crore (9.9 per cent of TIO) and was 12.4 per cent more than the Rs 243.53 crore (11.4 per cent of TIO) in Q2-2015. For 9M-2015, PAT at Rs 641.55 crore (10.4 per cent of TIO) was 22.6 per cent more than the Rs 523.44 crore (9.2 per cent of TIO) in 9M-2014.

GCPL’s PAT was highest, both in terms of absolute rupees and percentage of TIO at Rs 334.14 crore and 19.4 per cent of TIO in Q4-2013. While PAT shows an increasing linear trend in absolute rupees during the 11 quarters under consideration, in terms of percentage of TIO, the linear trend is downward.

GCPL says in its earnings release that all categories have grown.

Household Insecticides

Household insecticides growth momentum has returned to normal levels and GCPL says that it clocked a growth of 16 per cent, well ahead of category growth. The company’s focus on improving market share continues and GCPL exited December 2014 with highest ever market share in this category. It launched a Neem Low Smoke Coil variant, to premiumise its coil franchise and aid market share gains. Good knight Fast card continues to see strong demand and the company plans to leverage its distribution strength for next level of growth.

Soaps

In Soaps, the company says that it continued double-digit growth momentum and outperformed the category (where growth recovered to low single digits) with a value growth of 11 per cent. GCPL says that it recorded strong growth across its key brands. This was aided by focused marketing campaigns, consumer offers and localised activation programmes. Gross margins during the quarter benefited from lower palm oil prices and have improved significantly.

Hair Colours

GCPL sustained strong growth momentum in Hair Colours and clocked a volume led sales growth of 10 per cent, despite a significantly higher base from last year. It says that it outperformed the category and gained further market share. Godrej Expert Rich Cr?me continues to gain market share, backed by a strong build-up in distribution and large-scale activation programmes.

Air Fresheners

Air Freshener brand, Godrej aer, continues to do well, aided by GCPL’s innovative gel format technology and consumer engagement initiatives. In little over two years of launch, it now features among the top 3 players in the car air care and home spray categories claims GCPL. The company recently launched a unique vehicle PUC renewal campaign to create awareness about air pollution.

Health and Wellness

GCPL’s recently launched Health and Wellness portfolio of hand washes, a hand sanitiser and anti-mosquito spray, under Godrej Protekt, is being well received in modern trade says the company.

Liquid Detergents

GCPL claims that Liquid Detergents sales have increased by 13 percent, despite the late onset of the winter and that Ezee continues to do well aided by the Ezee ‘Rahaat Ek Abhiyaan’ campaign.

Company Speak

Commenting on the financial performance of Q2-2015, Godrej group chairman Adi Godrej said, “After a few quarters of sluggish growth, consumer demand in India started to show early signs of a recovery in the third quarter of FY 2015. Our business has delivered strong, competitive double-digit growth across categories. We have also further strengthened our leadership positions across our core categories.

Consolidated organic constant currency sales increased by 16 per cent, ahead of the market. Organic constant currency operating earnings growth was even stronger at 28 per cent, led by prudent cost management, benign raw material costs and our efforts to effectively leverage our brand platforms.

In organic constant currency terms, our international business registered a robust top-line growth of 20 per cent and an operating earnings growth of 43 per cent.

After a challenging few quarters, the growth prospects of the Indian economy are looking more favourable. We expect the economy to pick up pace in FY 2016. We are beginning to see improved consumer sentiment on the ground and are hopeful that this will translate into better consumer demand in the quarters ahead. With our relentless focus on innovation, we are in a good position to capitalise on the uptick in demand and growth. We will continue to focus on sustaining and extending leadership in our core categories. We are becoming operationally more efficient, while investing for the longer term.

We expect growth in the second half of this fiscal year should be better than the first half. Consequently, our intent is to deliver a stronger performance overall this year, compared to the previous year.

The medium and long-term growth prospects in India and our other emerging markets remain robust. I am confident that with our clear strategic focus, differentiated product portfolio, superior execution and top-notch team, we will continue to deliver industry-leading results in the future.”