US ad spend up by a marginal 0.9% in Q2: Kantar Media

MUMBAI: Total advertisement expenditure in the US in the second quarter of 2012 increased 0.9 per cent from a year ag

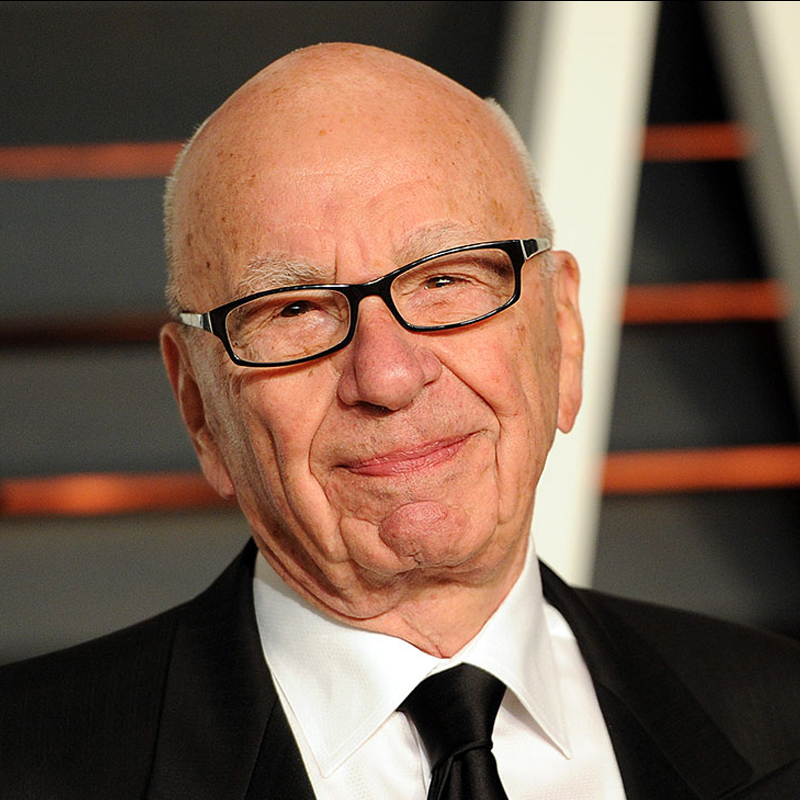

MUMBAI: News Corp Chairman and CEO Rupert Murdoch is eyeing Los Angeles Times and Chicago Tribune from its financially struggling owner Tribune Co to bolster his print business, which boasts of Wall Street Journal and the New York Post.

The company wants to secure a foothold in Los Angeles and Chicago and is in early talks with Tribune Co debt holders which includes hedge fund Oaktree Capital.

Murdoch is looking to buy the Los Angeles Times from struggling media conglomerate Tribune Co, whose books were recently examined by News Corp executives and Murdoch‘s son James Murdoch as part of due diligence process.

However, Murdoch‘s plan to expand his newspaper business might face regulatory hurdles since News Corp also owns TV stations in both the markets. Federal Communications Commission rules prevent media ownership of a newspaper and TV station in the same market.

Murdoch might also have to battle other potential bidders such as venture capitalist and ex-LA deputy mayor Austin Beutner, Orange County Register owner Aaron Kushnere, and San Diego real estate mogul Doug Manchester.

The move is seen as a precursor to News Corp‘s decision to split the television and film business from the loss making print business. This coincides with Murdoch‘s forced retrenchment from part of the print business in the UK.

The American print market has been battling declining circulation and advertising revenue since 2007 with ad revenue dropping almost 50 per cent to $24 billion, according to the Newspaper Association of America. But Murdoch sees promise in consolidating the market and also having an online extension of the print publications.

In 2011, News Corp was ravaged by phone hacking scandal at its UK publishing business which led to the shutting down of News of the World newspaper.

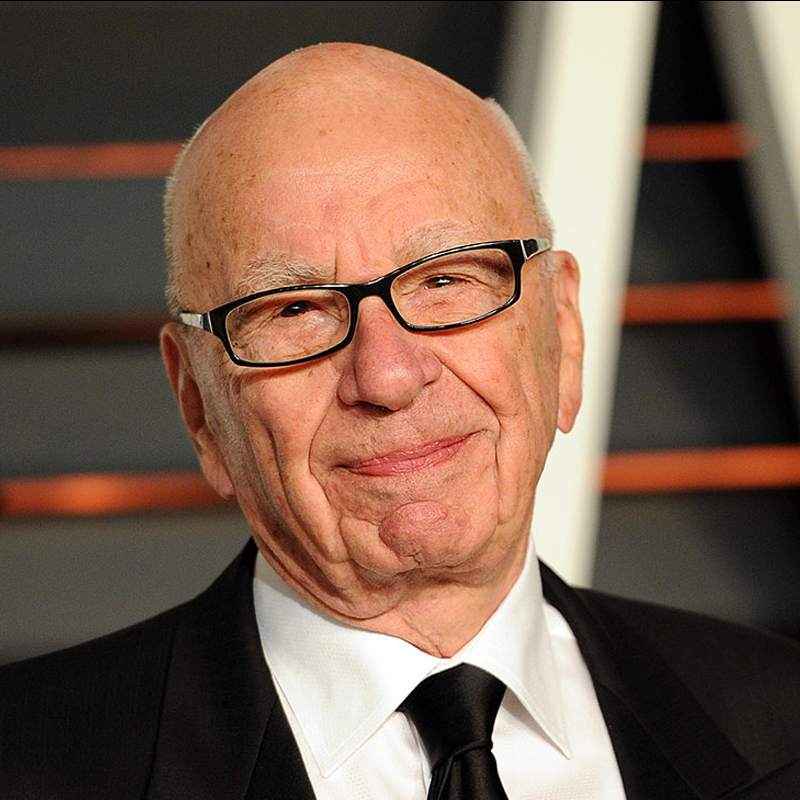

MUMBAI: Rupert Murdoch has once again proved his critics wrong getting re-elected as the chairman and chief executive officer of News Corporation at the company‘s annual general meeting in Los Angeles Tuesday.

Murdoch overcame opposition from shareholders who were hell bent on cutting him and his members to size by getting both his sons - Lachlan and James Murdoch - re-elected. Shareholders also re-elected the rest of the company‘s returning board members even as angry shareholders criticised Murdoch and the control that he wields on the company.

The Murdochs have been going through the worst phase of their lives ever since the phone hacking scandal broke out at its UK publishing business News International which led to the closure of News of the World and arrest of employees.

The scandal also led to a huge furore in UK and subsequently US about the company‘s corporate governance structure. It also diluted the power that Murdoch once wielded in UK and exposed them to tough action from UK authorities.

While only five per cent of investors voted against re-electing Murdoch during this year‘s meeting which is in sharp contrast to last year‘s when 16 per cent shareholders had voted against his re-election. But last years AGM was held at the height of phone hacking scandal which subsided with the Ofcom giving clean to News Corp‘s broadcast business BSkyB.

However the sons were not as lucky as their father with 17 per cent shareholders voting against James and 21 per cent against Lachlan.

It is News Corps dual class shareholding that helped Murdoch to sail through amidst opposition from powerful pension fund outfits that wanted to curtail the power of Murdoch family and separation of chairman and CEO‘s post.

The Murdoch family holds 12 per cent but its dual class shareholding structure gives it 40 per cent of the voting power. Add to that the backing of second largest investor Prince Al-Waleed bin Talal, who holds seven per cent in the media conglomerate. The dual structure gives Prince Al-Waleed almost 20 per cent voting power.

Meanwhile, 28 per cent shareholders voted in support of eliminating the division between voting and non-voting shares.

During his AGM speech Murdoch asserted that the media conglomerate has strengthened its corporate governance across the globe with modernisation of compliance across the board.

The company has appointed Gerson Zweifach as Chief Compliance Officer and compliance structure has been divided into five groups to cover all the regions.

"We have acknowledged the serious wrongdoing that occurred at some of our publications in the United Kingdom. As a result, we have had to work hard to make amends. But just as important, we seized the moment as an opportunity to strengthen our governance and our organization in key ways.

"Under the guidance of our general counsel Gerson Zweifach -- who now also serves as our Chief Compliance Officer -- we‘ve modernized our entire system of compliance from top to bottom.

"We‘ve organized this new global structure into five compliance groups that together cover every region where we operate and every business within it.

"We‘ve imposed strict, uniform policies with centralized oversight. We‘ve improved employee training. We‘ve also imposed more auditing and testing, so that we can fix any problem by identifying it early. And we‘ve backed it all up by appointing top-notch professionals who have a track record that cannot be questioned-- including a former director of enforcement for the U.S. Securities and Exchange Commission and a former U.S. federal prosecutor."

He also said that there will be special emphasis on UK since the phone hacking scandal took part in that market. He also claimed that the company‘s other publications did not not any sort of wrongdoing.

"Because these problems were based in the United Kingdom, we‘ve put a special emphasis on our operations there. As you might expect, this has meant especially rigorous internal reviews. And we have confirmed that the problems in the United Kingdom were not found at our other publications.

"Our findings were born out by the recent, in-depth report by Ofcom, the United Kingdon‘s independent media regulator. After looking at the evidence related to phone hacking, Ofcom found no basis for concluding that News Corporation acted inappropriately in any way."

Murdoch also acknowledged that the company is going through one of the worst period in its history. He also said that despite all the problems that inflicted the company it has continue to grow.

"This has been a difficult period in our company‘s 50-year history. However, I believe the numbers will bear out that the market likes the work we are doing and has confidence in our future. Since addressing shareholders a year ago, our stock price has risen nearly 45 per cent," he added.

And to take this growth to the next level the company is being split into two separate trading companies which will also help it unlock more value for its media and entertainment unit.

"Let me conclude with what you know is our biggest potential change and opportunity in the coming year: the transformation of one of the world‘s most successful media companies into two separate, publicly-traded companies. One will be focused on news, publishing and education. The other will focus on media and entertainment.

"We are pursuing this for a simple reason. Notwithstanding our success, our company is undervalued. With this separation, we will free up each company to better deliver on its promises to customers across the globe. As we do, it will also mean unlocking more value for our shareholders.

"As we head into this future, the company you know will be replaced by two dynamic new ones with separate names and different missions. But they will be driven by the same ethos of creativity, competition and entrepreneurship that has always been at the heart of our efforts.

"This split will take time, but it is my expectation that by the end of the calendar year, we will be ready to announce more details about the executive management structures and Board memberships. I am deeply excited and energised by this future, and I hope you are as well."

MUMBAI: News Corp chief Rupert Murdoch is in the line of fire ahead of the company‘s 16 October annual general meeting with the Florida State Board of Administration (FSBA) voting to remove Murdoch and his sons James and Lachlan Murdoch from the News Corp board.

According to Daily Telegraph, FSBA with assets worth $150 billion under its control has backed calls for an independent chairman to be appointed, and voted for the abolition of News Corp?s dual-class share structure, which hands the Murdochs a disproportionate amount of power.

FSBA is the latest among the list of powerful pension funds to have called for Murdoch‘s head. The funds believe that Murdoch has compromised on the corporate governance.

Earlier, California Public Employees? Retirement System (Calpers) and the California State Teachers? Retirement System (Calstrs), the two largest pension funds in America with combined assets of nearly $400 billion, have voted him out. The Calpers and Calstrs had also called on News Corp to split the roles of chairman and chief executive.

However, Murdoch is unperturbed by these developments. ?Any shareholders with complaint should take profits and sell!? the unabashed Murdoch had posted on his Twitter account.

Murdoch is banking on arithmetics to sail through the current crisis. The Murdoch family holds 12 per cent but its dual class shareholding structure gives it 40 per cent of the voting power.

Add to that the backing of second largest investor Prince Al-Waleed bin Talal, who holds seven per cent in the media conglomerate. The dual structure gives Prince Al-Waleed almost 20 per cent voting power.

With 60 per cent voting power in its kitty, the Murdoch family has the ability to push through their decisions and at the same time stall decisions that might not be in their interest.

And much to Murdoch‘s relief, ISS, the influential US shareholder advisory body, has thrown its weight behind Murdoch after calling for his removal from News Corp at the height of phone hacking scandal.

A year ago ISS wanted no less than 13 of the 15 directors to be rejected. However in an about turn, it has thrown its weight behind all the directors.

Talking of phone hacking, former News International CEO Rebekah Brooks was reportedly given a payout package worth about ?7 million pounds after stepping down following the phone hacking scandal.

MUMBAI: News corp owned Shine International CEO Camilla Hammer has called it quits for personal reasons. Nadine Nohr will be the interim CEO.

Shine Group CEO Alex Mahon said, "We are sorry to see Camilla leave but understanding and respectful of her decision to do so. She has steered Shine International to be on course for another record year of growth, buoyed by successful sales campaigns for recent scripted properties, including the second series of the critically acclaimed ‘The Hour‘ and forthcoming Frank Spotnitz-penned ‘Hunted from Kudos‘, in addition to the ongoing strong performances of our global formats such as ‘MasterChef‘.‘

Nadine steps into the role not only as an incredibly experienced international distribution executive but one well known to both the Shine team and clients given her three years of consulting with it."

MUMBAI: News Corporation has completed its $2 billion acquisition of Australia media company Consolidated Media Holdings, which holds 50 per cent of Fox Sports and 25 per cent of Foxtel.

News Corp had on 20 June made a $2 billion bid to wrest control of CMH which would give it a greater share of Australia‘s pay television market. CMH‘s board backed the offer in the absence of a higher bid.

The buyout will see the exit of Australian billionaire James Packer from media business as he sets out for a bigger play in the gambling business. Packer, the son of late media baron Kerry Packer, held 50.1 per cent stake in the CMH.

The deal will give News Corp‘s Australian subsidiary News Limited a complete ownership of Fox Sports, an equal joint venture partnership between Consolidated Media and News Corp, and a 50 per cent stake in pay TV operator Foxtel, which is half owned by Australian telecom and media company Telstra Corporation with News Corp and CMH holding a 25 per cent stake each.

As per the agreement, News Limited and News Pay TV Financing (News), 100 per cent owned subsidiaries of News Corporation, will acquire CMH for $3.45 cash per share by way of a scheme of arrangement.

The scheme consideration of $3.45 represents an implied multiple of 9.4x EV/Ebitda based on a proportional consolidation of CMH‘s main investments in Foxtel and Fox Sports.

CMH‘s major shareholders CPH executive chairman James Packer said, "I am delighted that CMH and News have reached agreement on the terms and conditions, and as I said in June, CPH will support the Scheme in the absence of a superior cash proposal. In my view, this is a great outcome for CMH shareholders and for News and it reflects a fair price."

The implementation of the Scheme is subject to a number of customary conditions including CMH shareholder and Court approvals.

switch

switch

switch

switch