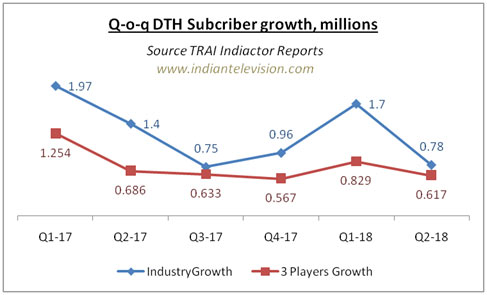

BENGALURU: The carriage industry and more specifically the direct to home or DTH industry had a disappointing fiscal year 2017 (FY-17, year ended 31 March 2017) in terms of subscriber growth. Going by the subscriber numbers data of the six private DTH players in India provided by the Telecom Regulatory Authority of India (TRAI) in its Indicator Reports of the Indian Telecom Sector. This dismal performance seems to have spilled over to the second quarter of financial year 2017 (FY-18, year commenced on 1 April 2017 until 31 March 2018) as per TRAI data for the quarter ended 30 September 2017 (Q2-18, quarter under consideration). The industry could add just 2.47 million subscribers during the first six months (first 2 quarters, 1 April 2017 to 30 September 2017) as compared to the 3.37 million subscribers it added during the corresponding year six-month period the year before. Active DTH subscribers added in Q2-18 were just 0.78 million as compared to 1.4 million in Q2-17.

Further, as reported by us earlier, despite the sunset date for DAS IV having passed, the DTH industry had not been able to leverage the opportunity that it was presented with. Earlier, TRAI numbers for the six private players in the DTH industry showed a very poor growth rate of just 0.96 million and 5.08 million during the quarter and year ended 31 March 2017 (Q4-17, FY-17) respectively. This figure is far lower – less than one-third of the 17.38 million active DTH subscribers that were added in fiscal 2016 by the six.

Please refer to the figure below - The three players whose numbers are available in the public domain and whose combined q-o-q subscriber growth has been represented in the figure are Dish TV, Airtel DTH and Videocon d2h

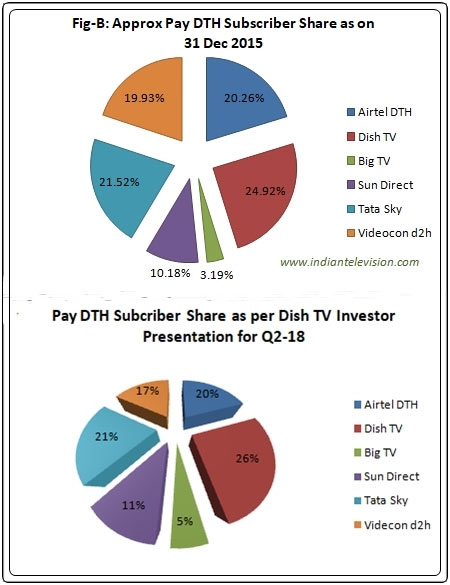

Let us understand the status of the DTH industry at the end of September 2017. The six private DTH players are – Dish TV, Tata Sky, Airtel Digital Services (Airtel DTH), Videocon DTH, Sun Direct, and the Anil Ambani-led Reliance Big TV (Big TV). It may be noted that Big TV announced closure of its operations since November 2017. The three players - Dish TV, Airtel DTH and Videocon d2h represented approximately 63 to 65 percent of the active pay-TV DTH subscribers at the end of September 2017. Please refer to figure below for subscriber share of the private DTH players as per data in the public domain:

Besides the six private pay DTH players, Doordarshan’s (DD) Free Dish DTH service is a major player in terms of subscribers with an estimated 22 million as per the numbers available in the public domain. It must however be noted that an exact number for registered or active subscribers is not available even with DD, since this is a free DTH service. When the announced Dish TV Videocon d2h merger happens, the merged entity will probably be one of the largest DTH players in the world in terms of subscriber numbers.

According to an E&Y report titled ‘India’s Free TV’ released in July 2017, among the DTH operators in India, DD Free Dish has grown to become the largest with its estimated 22 million subscribers which E&Y predicted could cross 40 million over the next two to three years.

A number of reasons can be attributed to this dismal performance – two of the chief ones that are touted over the recent past by most players in media and entertainment industry – demonetisation in November 2016 and the implementation of GST. Another important reason could be that DTH is considered a premium service – by all the stakeholders in the carriage ecosystem with the resulting perception that procurement as well as monthly subscription will be premium and hence a deterrent for the consumer. While some players such as Dish TV have been making attempts to come up with packages that it perceives should attract the masses, but, results as per TRAI data seem to indicate otherwise. Yes, Dish TV is the largest private player in the country that has come up with different pricing models under different brands. Whether unwittingly or not, most of the other players present themselves as premium players and seem to have done little in that direction.